North America

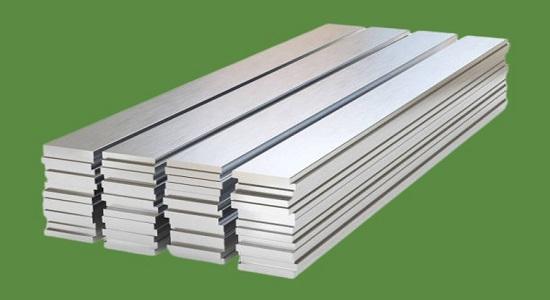

As the fourth quarter of 2022 ended, Stainless Steel prices showed a dwindling price movement due to falling downstream inquiries and higher inventories. Buyers were focused in October on reducing inventories across all flat products through the end of the year, which kept them out of the spot market. Mills had attempted to remain competitive with import offers despite falling scrap prices, as downstream demand from new projects did not warrant additional spot buys or bookings of larger imports or rising financing costs. Mill margins were under pressure as input costs rose and the continued push to use more scrap in furnaces. According to manufacturers, downstream demand was difficult, and any increase in scrap was likely to erode mill margins. Thus, the SS 304 HR Plate (6 x 1250 x 2000) prices for Ex Texas (USA) settled at USD 3978/MT.

Asia Pacific

Stainless Steel (Flat) prices in the Chinese market edged downward in the fourth quarter of 2022 due to higher inventory levels and limited purchasing activity amid COVID-19 control and prevention measures. Stainless Steel (Flat) prices rose in October due to an unexpected arrival following the festival, a shortage of certain specifications, and raw material supply concerns. The demand effect in the favorable trading seasons was fading as the traditional slack season began, and overall demand for stainless steel was weak. The domestic epidemic situation was complicated. Logistics were clogged, downstream procurement willingness was low, and the transaction required robust inquiries. On the demand side, stainless steel prices rebounded more in mid-December, influenced by futures prices, providing some profit margin to NPI plants. Thus, the (Stainless Steel HR Coil Prices) SS 304 HR Plate (6 x 1250 x 2000) prices for FOB Shandong settled at USD 1576/MT.

Europe

In the fourth quarter of 2022, Stainless Steel (Flat) prices showed stagnation in the German market due to limited buying inquiries and higher inventory levels. Buyers who ordered SS HRC for December delivery reported that the material was already available in early Q4, with lead times from several mills as low as two weeks. Despite the falling prices and short lead times, inquiries from downstream players remained low. Order cancellations also resulted from energy cost uncertainty and demand destruction. In December, some mills planned to keep Christmas production shut down for longer than usual. Given that supply still vastly outnumbers demand, market participants remained pessimistic about the impact of such prolonged stoppages on prices. Some mills have stopped trading and will re-enter the market in the first half of January. Due to the ripple effect, the SS 304 HR Plate (8 x 1350 x 2000) prices for Ex Ruhr (Germany) settled at USD 3361/MT.

ChemAnalyst tackles the primary difficulty areas of the worldwide chemical, petroleum, pharmaceutical, and petrochemical industries, empowering decision-makers to make informed decisions. It examines and analyses geopolitical risks, environmental concerns, raw material availability, supply chain functioning, and technological disruption. It focuses on market volatility and guarantees that clients manage obstacles and hazards effectively and efficiently. ChemAnalyst's primary expertise has been data timeliness and accuracy, benefiting both local and global industries by tuning in to real-time data points to execute multibillion-dollar projects internationally.