In 2022, Saudi Arabia’s ministry of finance approved a budgeted revenue of SAR1,045 billion, an increase of 12.1% over 2021. the growth is backed by improvement in domestic economy, coupled with positive trend in oil prices – a result of global demand increase and Ukraine conflict. The oil & gas sector is expected to remain a key source of revenue for government during 2022-2024; represented ~73% of total revenue in 2022.

After witnessing turmoil in the oil-based economic growth for a decade (2010-2019), KSA is currently focused on transition. Over the next decades (2020-30), the Kingdom has envisioned a prosperous and self-dependent economy through its “Vision 2030 Program

KSA vision 2030 under the National transformation program aims to contribute close to 80% of trade in retail sector through modern trade and E-commerce. KSA also plans to invest in US$ 100 billion in Logistic infrastructure

The government’s efforts on economic diversification will gradually reduce the reliance on the oil & gas sector.

Government of KSA emphasizes on automotive sector as key revenue generator and is promoting the FDI inflow. Global OEMS are also planning to set up production bases in KSA. Saudi Arabia is significantly spending on transport and business infrastructure development, which is attracting executives and professionals from across the world. These developments augur well for the car rental and leasing market in KSA for the next 10 years

The vehicle rental market in Saudi Arabia is expected to exhibit a healthy growth rate owing to the increase in business and leisure tourism. Car rental services are being used not only by the tourists but also by the local people for daily commuting, with the increase in number of companies setting up businesses in Saudi Arabia, the population of office goers is increasing and the demand for car rental services is also increasing at a higher rate

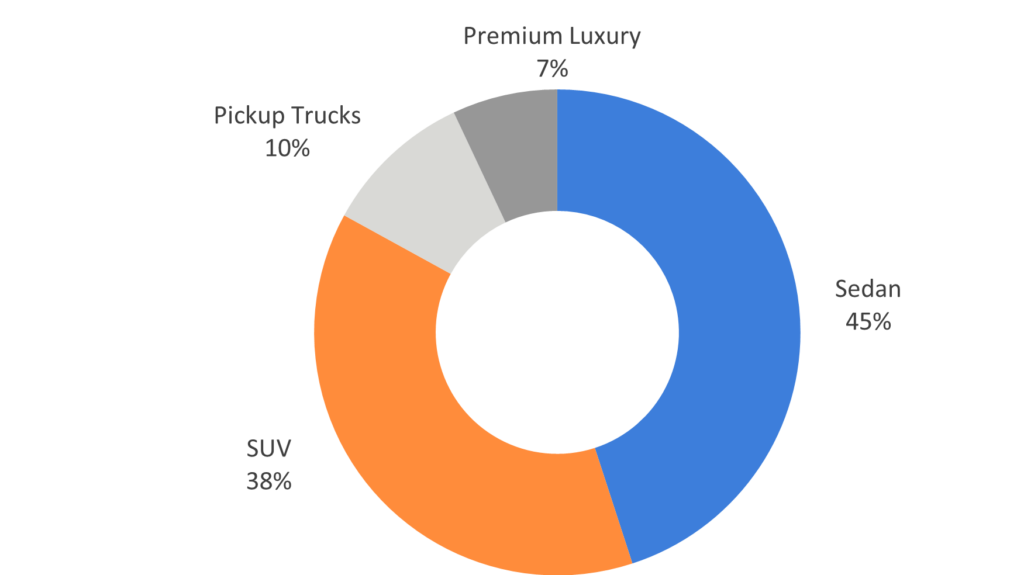

The number of companies setting up businesses in the country is increasing at a high rate because of the government initiatives to boost investment in the country, The car leasing segment is primarily dominated, with corporate demand especially from the industries such as logistics, construction, and oil and gas, with considerable demand for transportation of equipment and employee mobility. The logistics industry has the biggest share in terms of demand, followed by FMCG and the e-commerce industry.

Click : https://www.glasgowinsights.com/blog/saudi-arabia-car-leasing-and-rental-market-to-reach-sar-10-billion-by-2027/

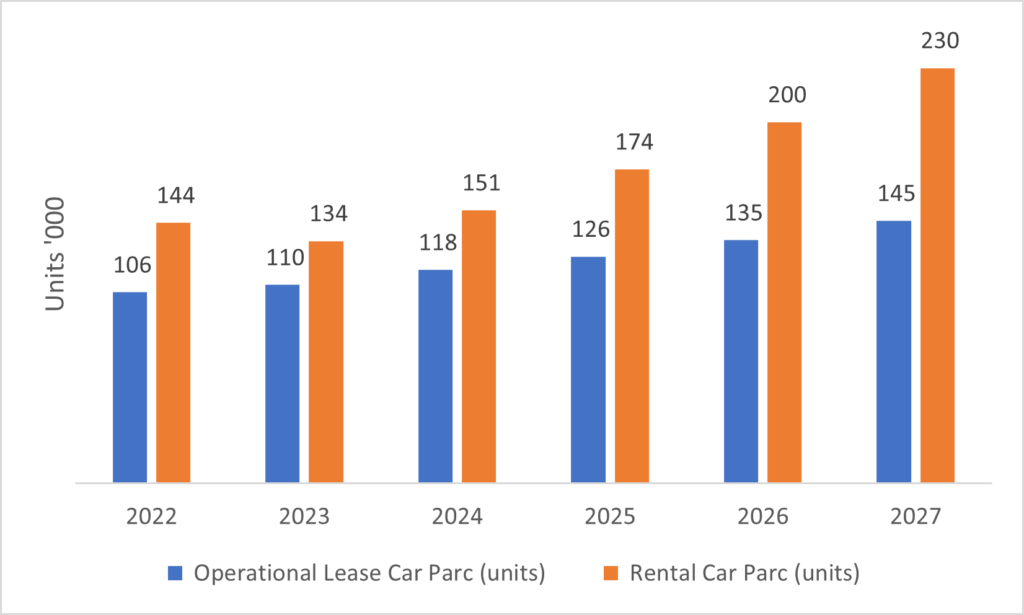

The Saudi Car Rental and Leasing market is estimated to be SAR 6,500 million in 2022, with 58% accounting for rental and the remaining 42% leasing. The market is expected to grow to SAR 9,800 million by 2027 growing at a CAGR of 8.6%

The Saudi Arabian car rental and leasing market growth is directly linked to the growth of establishments, the construction, logistics, and oil and gas sectors, employment and GDP, and the number of tourist arrivals in the country. In January 2021, transport authorities issued e-license for car rental brokerage that will owners of cars to increase their incomes and ensure rental of road fit cars

The growing tourism sector is expected to drive the rental market by 2025. The country plans to welcome 100 million tourists by 2030. The government’s drive to improve standards in the car rental segment (for example, the launch of a unified rental contract in 2020) are likely to improve transparency in contract terms in the industry and reduce mitigation costs. Besides these, women drivers are expected to have a positive impact on the leasing & rental sector

The government in the country is taking necessary steps to regulate the car leasing industry with new rules for the benefits of customers and service providers.

Share of KSA Rental and Leasing vehicles by type

Several players in the market are expanding their fleet size with the latest models, entering new partnerships, and raising funds through investors to capture the growing market. Many new rental companies are entering the market, and it will continue in the coming years. Companies are competing with the existing players by providing customized services, new fleet, and low pricing strategy. Companies will continue to focus on keeping themselves ahead on the basis of value-added services provided to prospective clients, reducing the service cost and introducing premium and well-maintained vehicle models into their fleet to capture a significant share in the market

The government’s push to relocate regional HQs of companies to KSA by 2024 is also expected to boost the demand for corporate rental and leasing. Expatriates coming into KSA on contracts of 3 to 4 prefer leasing of cars. Also, the Kingdom’s focus on developing tourism and expanding Hajj / Umrah capacity to accommodate 30 million pilgrims by FY30, the tourist rental market is expected to see significant growth.

The overall market car rental and leasing in Saudi Arabia is fairly fragmented by numerous domestic players and few significant international players such as Al Jazirah, Theeb, LUMI, Hertz, Avis, Sixt SE, and Budget Rent a Car.

Digitalization is key to expanding customer reach and ensuring sustenance. As the market matures, focusing on consumer retention and easy customer service experience will help companies stand out. Online tourist vehicle bookings are increasing in the country and globally due to the rising usage of smartphones, and the growth in the number of users prefer online channels.

With the growing trend in technology, renting a vehicle through online booking has become the most preferred choice for customers over the past few years. Moreover, it provides additional facilities to monitor a rental vehicle’s operation, performance, and maintenance in real-time. Such features are tremendous assets for drivers and fleet managers, enabling them to better and more efficiently identify risks and implement timely improvements to their rental services. App developers have been designing mobile rental applications with more advanced booking features that offer more vehicle availability and comparable rental costs on a single platform

The economic development of Saudi Arabia is growing at a rapid pace and it is expected to increase in the coming years this would directly have a positive impact on the car rental and leasing market.